[ad_1]

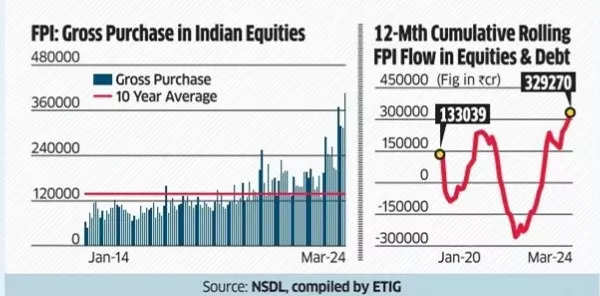

Foreign institutional investors (FII) recorded a new high of Rs 4.06 lakh crore ($49 billion) in gross purchases in March, marking the first time they crossed the Rs 4 lakh crore mark in a month.This surge was nearly 1.65 times higher than the last one-year average of Rs 2.46 lakh crore, with gross purchases exceeding Rs 3 lakh crore for the fourth consecutive month, according to an ET analysis.

The influx resulted in a net inflow of Rs 35,098 crore ($4.2 billion) in equities for India, boosting the 12-month cumulative equity inflow to a 32-month high of Rs 2.08 lakh crore ($25 billion). In the first half of March alone, FPIs injected a net inflow of $4.9 billion, a rare occurrence over the past five years according to NSDL data. According to NSDL data, in the past five years, there have been only four occasions when FPIs invested over $4 billion within a fortnight.

FPI: Gross Purchase in Indian Equities

In contrast, domestic funds invested Rs 1.8 lakh crore in equities over the previous 12 months up to February 2024. The shift in valuation approach from CAPE to PEG for Indian equities by investors has played a role in attracting foreign investments.

Also Read | Steadily climbing returns from FCNR! Overseas Indians send home record $29 billion in remittances

A recent CLSA report highlighted that India’s current valuation metrics do not fully capture the earnings potential. The PEG ratio, which considers the 12-month trailing PE divided by annualized 24-month EPS growth, indicates that India is trading at 1.4x compared to the historical average of 1.8x. As of the first half of March, FPIs managed assets worth $756 billion, showing a 42% increase year-on-year.

FPIs represent about 18% of the total market capitalization and a third of the free float market in India. Despite the recent surge in foreign investments, domestic inflows have been strong in the market, resulting in a gradual decline in the foreign share of India’s total market cap from its peak of around 24-25%.

[ad_2]

Source link