[ad_1]

The sensex and Nifty opened the day’s session in the red and lost ground through the session to close near their respective intraday lows. The sensex closed at 72,012 points, down 736 points or 1%, while Nifty was at 21,817 points, down 238 points or 1.1%.

Since its record high close of 74,119 points on March 7, the sensex has dived over 2,000 points. The 736-point loss on Tuesday was the worst since March 13, when the index sunk by over 900 points. Globally too, stocks saw small moves ahead of the highly anticipated US Federal Reserve decision that will help shape the outlook for interest rate cuts this year, Bloomberg reported.

Tuesday’s slide in the market came on the back of selling by domestic high networth investors, market players said. End-of-the-session data on BSE showed that while domestic funds were net buyers at Rs 7,449 crore, foreign investors too were net buyers at Rs 1,421 crore. The day’s slide left investors poorer by Rs 5.2 lakh crore with BSE’s market capitalisation now at Rs 380.6 lakh crore.

According to Vinod Nair of Geojit Financial Services, after Bank of Japan hiked interest rates, the mood in Asian markets turned bearish, which pulled the Indian market to continue with its recent southward movement.

“The correction has also been triggered by concerns over premium valuations and the delay of rate cuts by the US Fed due to hotter than expected inflation, which is evident from the upward trend in the dollar index.” Additionally, the gradual increase in crude oil prices is also dampening market sentiment, Nair said.

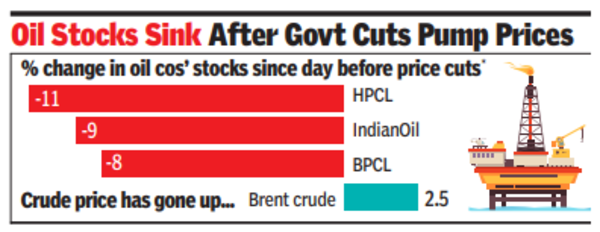

The rising crude oil prices, along with the decision by oil marketing companies (OMCs) last week to cut prices of petrol and diesel just before the announcement of the dates for the Lok Sabha polls, is weighing heavily on these companies. On Thursday, OMCs cut prices of petrol and diesel by Rs 2 per litre. Incidentally, crude oil prices also started rising from around that time.

[ad_2]

Source link