[ad_1]

“Based on feedback from taxpayers on the e-campaign for advance tax, the department has identified certain inconsistencies in data of the securities market (SFT-17) provided by one of the reporting entities.The reporting entity has been asked to submit a revised statement based on updated information. Hence, the data on AIS (annual information statement) will be updated. Taxpayers are advised to wait for further updates on AIS based on the revised statement,” the Central Board of Direct Taxes said in a social media post.

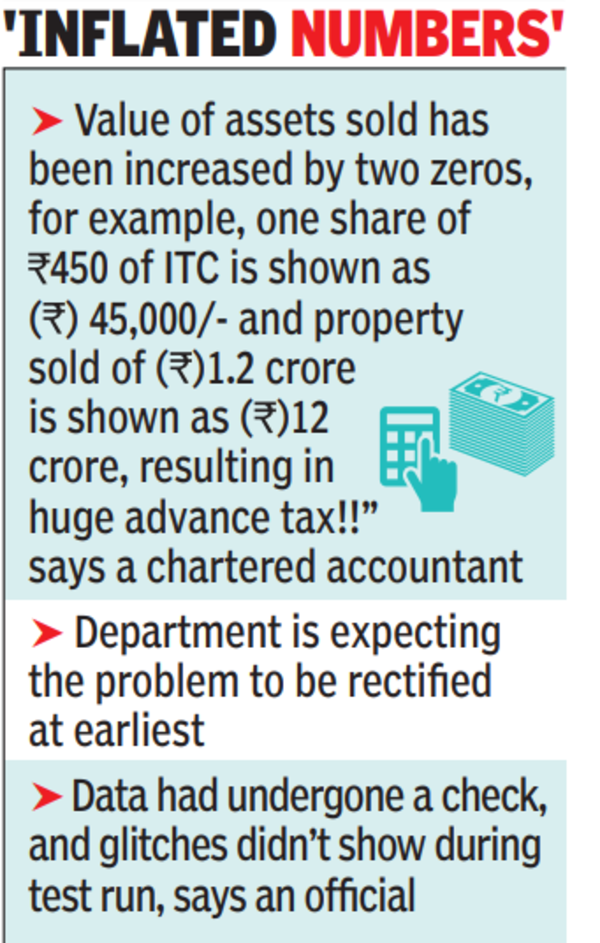

The problem arose due to data sharing issues between Central Depository Services (India) or CDSL and the tax department with several users pointing out that the number was getting inflated with one or two zeros getting added, an official told TOI.

The department is expecting the problem to be rectified at the earliest, given that efforts are on at a “war footing”. The fourth and final instalment of advance tax is due to be paid by Friday and officers were hopeful of the issue being resolved soon.

“The value of assets sold has been increased by two zeros, for example, one share of Rs 450 of ITC is shown as 45,000/- and property sold of (Rs) 1.2 crore is shown as (Rs) 12 crore, resulting in huge advance tax!!” a chartered accountant posted on social media, while attaching a screenshot.

Another official said the data had undergone a check, and glitches didn’t show during the test run. Over the last few years, authorities have been nudging taxpayers to look at their AIS to promote voluntary compliance. AIS is the extension of Form 26AS, which has details of property purchases, high-value investments, and TDS and TCS transactions carried out during the financial year. AIS also includes interest accruing in your savings bank account and deposits, dividend, rent received, purchase and sale transactions of securities and immovable properties, foreign remittances, as well as GST turnover.

[ad_2]

Source link